Powered by GO for Catholic Schools

Support Cascia Hall

Use your state tax dollars to benefit our students.

What is GO for Catholic Schools?

The GO for Catholic Schools Tax Credit Fund makes an education at Cascia Hall more accessible for families and helps enhance the the quality of education for all students.

When you contribute through

GO for Catholic Schools, you earn the benefit of a 75% state income tax credit for your contribution and the dollars you designate go to create need-based financial assistance for students to attend

Cascia Hall Preparatory School.

GO for Catholic Schools is great for...

Love

Our Students

- Cultivates every student’s potential and puts them on the path to success.

- Breaks down educational barriers for students from every background.

- Empowers families to afford the Catholic education they always dreamed of.

Unity

Our Community

- Know where your money goes rather than letting the government decide.

- Make a real difference and support the Catholic education you believe in.

- Pay it forward and

Take Credit!

Earn a tax credit on your state return — more valuable than a deduction.

How it works.

Transform your state income tax dollars into need-based financial assistance for students at Cascia Hall Preparatory School by earning a significant state income tax credit for your contributions.

Two Contribution Options

Your support costs you little to nothing after accounting for the tax benefits, but makes a major difference for our Cascia Hall community!

Two-Year

Contribution Pledge

Make a 2-year pledge, get

75%

of your contribution back as a state income tax credit each year.

One-Year

Contribution

Make a single contribution, get

50%

of your contribution back as a state income tax credit each year.

Three Contributor Types

(based on tax filing status)

Individuals

Earn up to

$1,000

in tax credits each year

Married Couples

Earn up to

$2,000

in tax credits each year

Businesses

Earn up to

$100,000

in tax credits each year

Testimonials

Karen Forbes

Board Chair, Class of '88

"As a Cascia Hall alum myself and parent of a current student, I appreciate the value of a Catholic education. I support GO for Catholic Schools and the effort to provide financial assistance to families seeking a Catholic school education for their children. The GO education tax credit program strengthens the Cascia community and allows us to offer a high-quality, well-rounded, faith-based education to more families."

Shawn Loader

Chief Financial Officer, Cascia Hall

"GO for Catholic Schools (“GO”) is a no brainer for our Cascia Hall community. GO has been a great partner to the school, helping to provide stability to our financial aid recipients and the school in general by administering a high-quality tax credit program. The families and businesses in our community that we’ve known and loved for many years play a critical role in helping GO carry out this partnership and we thank you for your utilization of this terrific program."

Mike Westbrock

Business Owner

"Our organization has supported GO for Cascia with the goal of providing quality, Catholic education to more families in Tulsa. Through its expert leadership, GO has coordinated this opportunity in an easy, organized manner that makes it beneficial for the students, the school, and our business alike."

Tim and Debby Jurek

"GO for Cascia is an excellent way to support Catholic education, which has been so important to families in Tulsa. It allows you to use some of your tax dollars to make an impact in our community. GO is easy and efficient."

A message from our Headmaster.

One of the biggest challenges facing Catholic education today at all levels is managing tuition. In a period of rising costs, both in infrastructure and in salaries, we face the very real problem of pricing ourselves beyond the reach of most people we are called to serve.

While I am very proud of the financial resources we have traditionally provided our families here at Cascia Hall over the years, the need continues to grow each year.

The funds we receive from the GO for Catholic Schools Tax Credit Program have been a wonderful blessing during my time as headmaster in aiding our efforts to provide the best Cascia Hall experience for all our families, especially those with demonstrated need. This area of funding has the potential to significantly expand the impact we can make in the lives of future students here at Cascia Hall and to help favorably build our future as a Church and as a society.

Thank you for your support of our mission as a Christian community and your commitment to helping provide a Cascia Hall education to any who hope for it.

Sincerely,

Fr. Philip Cook

Headmaster

GO for Cascia FAQs

-

Can I contribute both individually/jointly and through my business?

Yes, you can contribute both individually (as a single person) or jointly (as a married couple) and through a legal business entity that you control. Either way, you or your business can earn a 75% state income tax credit. The business contribution route can be better beacause it allows you to contribute at a higher level and to gain a tax deduction in addition to the tax credit which maximizes your tax savings.

-

How can a tax credit save me more than a tax deduction?

Think of a tax credit as a gift card that you can use to pay your taxes. Tax credits directly reduce your tax burden on a dollar-for-dollar basis. The value of a tax deduction depends on several factors specific to each taxpayer. A tax deduction only reduces the base of your taxable income and therefore only indirectly reduces your tax burden by saving you cents on the dollar.

-

Where does my contribution go?

Your contribution through GO for Cascia funds need-based financial support for students to attend Cascia Hall Preparatory School. By law, you cannot designate a specific student or family to benefit from your contribution.

In addition, your GO contribution helps Cascia Hall achieve key aspects of its strategic plan and mission for the community, enhances the overall quality of a Cascia Hall education, and preserves the ability of Cascia Hall to serve students and families for generations to come.

Our 2023 Contribution Goal

$500,000

Your support costs you little to nothing after accounting for the tax benefits, but makes a major difference for our Cascia Hall community!

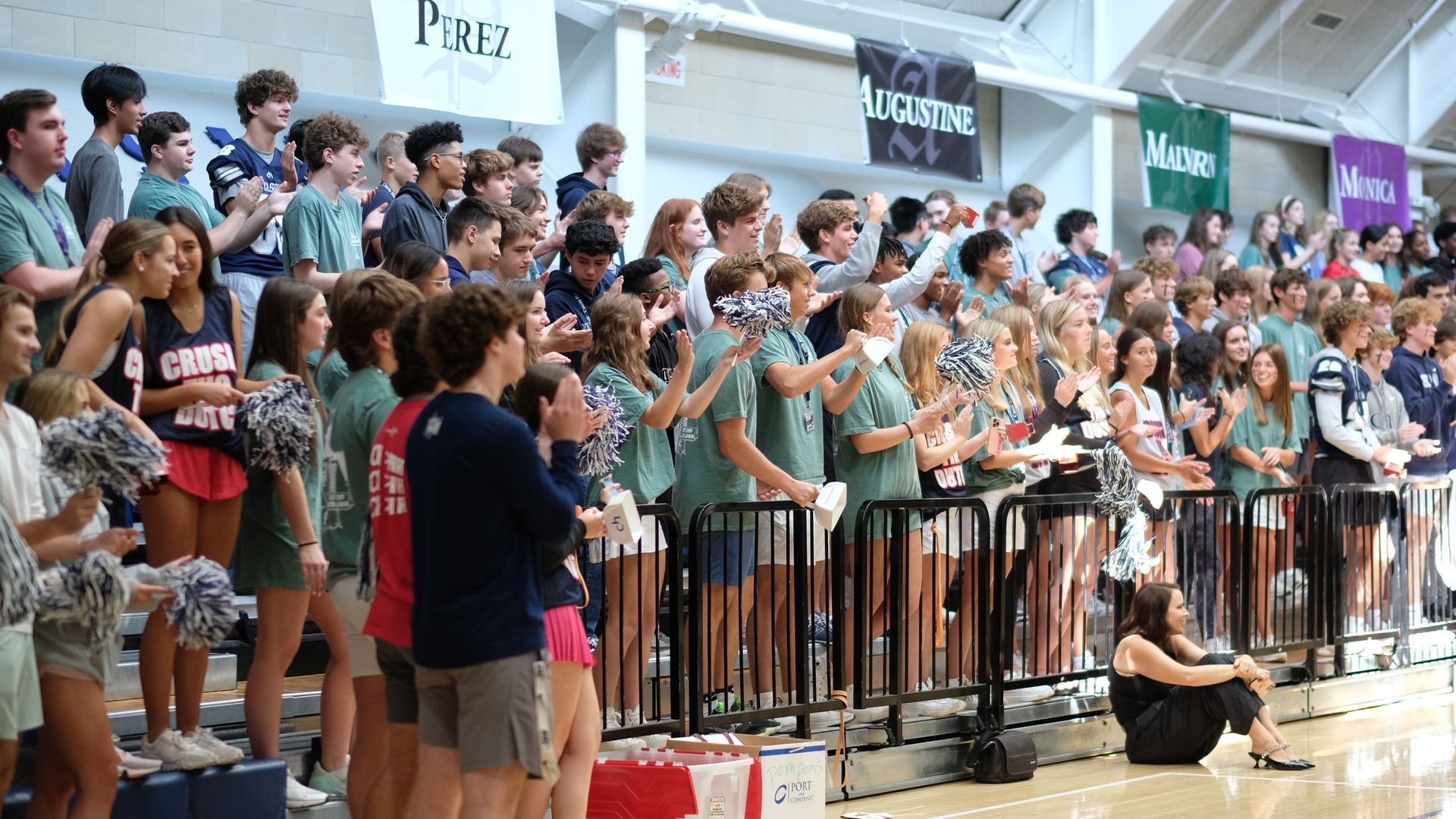

Your Contributions at Work

Contributions through the education tax credit program allow us to meet needs in our community for a high quality Catholic Augustinian college preparatory education. Our students leverage access to the highest caliber faculty, challenging academics, extra-curricular programs, and a broad range of backgrounds, opinions and skillsets of their fellow students at Cascia Hall. Maintaining these assets as well as the buildings and infrastructure to support them takes significant capital.

Support Cascia Hall Preparatory School.

Save more on your tax bill.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

GO Power Schools LLC | Privacy Policy